Panoptic: Solving DeFi’s perennial option problem

How to avoid fragmented liquidity, toxic flow, oracle problems, and more.

Derivatives markets are gargantuan compared equities – often estimated at over $1 quadrillion notional on the high end. Around 33 billion counts of options contracts were traded in 2021. Yet today, the total value locked in DeFi options is barely half a billion, majority of crypto options trading happens on Deribit, and we haven’t found a way to open leveraged options positions yet.

I’m impressed by what Guillaume and Jesper are building at Panoptic and believe their model presents an intensely powerful and DeFi native solution. This article will give a broad overview of the DeFi options landscape, its core issues, and why Panoptic matters. Onwards.

A quick rundown on options

A call option gives the owner of the option the right to buy an asset at a certain price, a put option gives the owner of the option the right to sell an asset at a certain price. In a peer-to-peer, centralized exchange, an option is written (sold) by someone, normally against collateral of the underlying asset. Someone can then buy this option and pay a premium to the options writer. DeFi’s decentralized options vaults, such as those of Ribbon Finance, are really automated options writers – the ETH you deposit into a vault is used as underlying to sell call and put options.

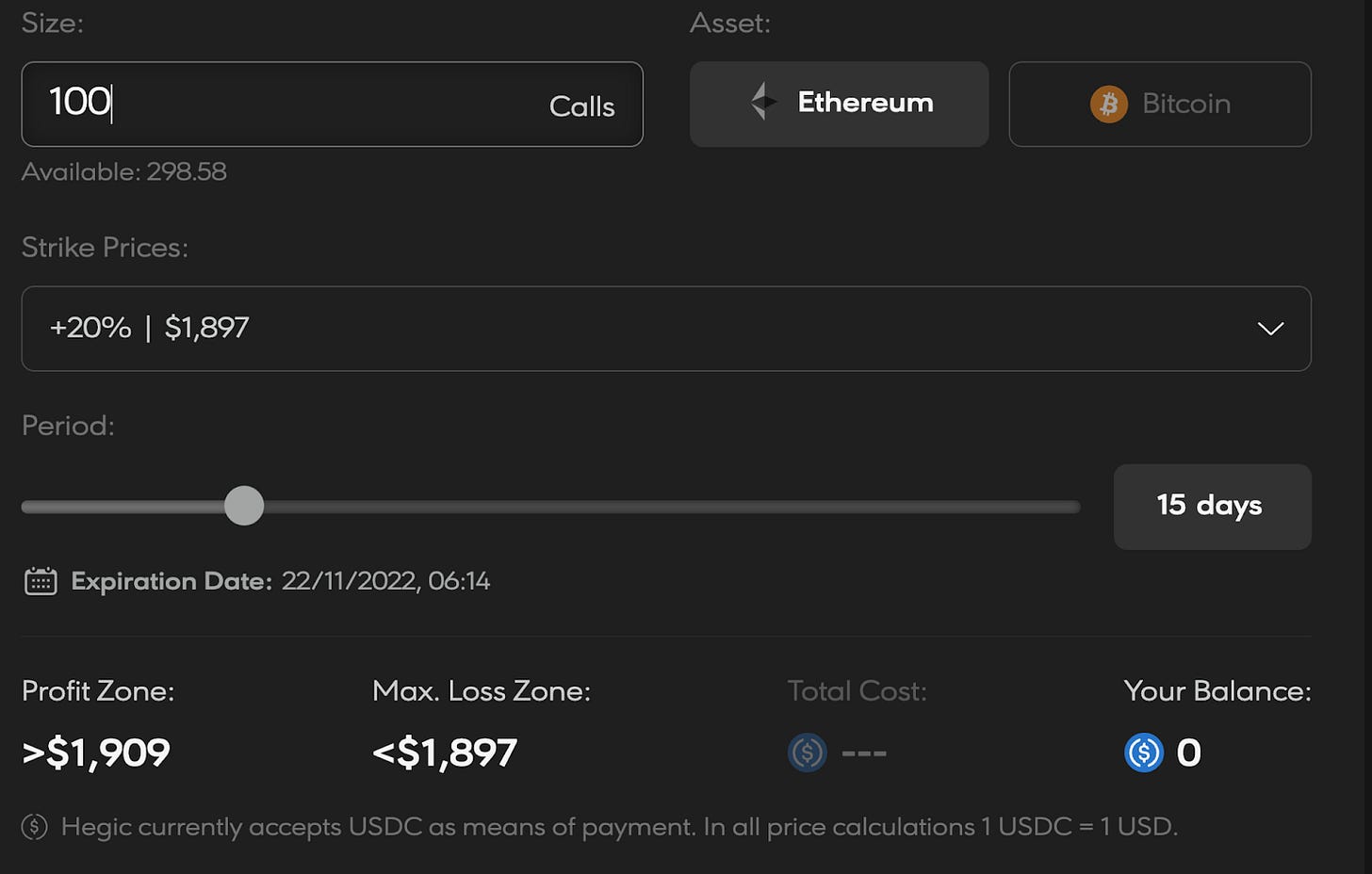

Traditionally, every option has a particular strike price and expiration date, and a notional size. For example, I could buy a 100 ETH Call at strike 1899 USD which expires in 15 days on Hegic right now. If spot ETH rises above 1899 USD, I’ll be able to exercise my right to buy 100 ETH and profit from the difference between the spot price and 1899, minus my options premium cost.

As you can tell, this difference in time horizon and strike prices fragments liquidity between options of a single asset greatly. Have a look at Dopex’s dapp page.

The DeFi options landscape has problems.

There are two types of options protocol models today: peer-to-peer and peer-to-pool models.

Peer-to-peer models, like on-chain spot order books before AMMs, are hindered by the overhead of on-chain order matching execution and are primarily implemented on high throughput chains or Layer 2s. Liquidity is always thin, and it is impossible to bootstrap markets for long-tail assets. PsyOptions was one example of this. One can have off-chain market makers offer quotations and allow any wallet address to be a taker, but that introduces partial centralization.

Peer-to-pool models involve options liquidity that is managed by a smart contract. Similar to spot Algorithmic Market Makers (AMMs), traders buy and sell options into this pool of options, and liquidity providers deposit into this pool to earn trading fees and options premia. Dopex, Premia, Lyra Finance, and Rysk are all peer-to-pool models.

The billion dollar problem today is how to price options in an automated manner while preventing toxic flow. Options pricing is a complex matter and can’t be represented by a simple x*y=k equation because there are many variables to consider – time to expiration, strike prices, volatility and more. If options pricing is not done correctly, liquidity providers lose out in the long run as smart market participants trade against them.

Options have been traditionally priced using the Black-Scholes-Merton Model. Amongst many intricacies, most peer-to-pool options protocols are essentially solving for two things: 1. utilizing the Black-Scholes-Merton Model to price option premiums on-chain and 2. ensuring prices are updated in an automated and timely fashion. Just to get an idea of how complex the Black-Scholes-Merton Model is, here’s a formula

Building in this direction is problematic, because:

The inputs into the model are difficult to determine. There is no clear answer as to what the risk-free rate in crypto is, for example.

Even if one has a way to magically select the right inputs, these inputs are commonly sourced off-chain, thus requiring frequent, rapid oracle updates. Latency between actual price changes and oracle updates allow bots to profit from lagging options repricing. Oracles are also one of the most frequent attack vectors in DeFi, as we’ve seen from the Mango Markets exploit and more.

Generalized blockchains are unlikely to offer computational power needed to update prices accurately and entirely on-chain. Traditional market making firms themselves use custom hardware (Field Programmable Gate Arrays) to update 1000’s of option prices at every spot tick change.

The Black Scholes Model may not hold for equities, much less cryptocurrency assets. It assumes the absence of gas and transaction fees and a lognormal distribution of spot prices, no dividends, no arbitrage opportunities… and many more.

And because pricing options is so hard, it is extremely difficult to build a proper margining system for one to take on leveraged options positions. Hegic, Premia, Opyn v3, and Lyra all have a margin requirement of 100% – not the most capital efficient. We haven’t even gotten to cross margining (using asset X as collateral to sell options for asset Y), or portfolio margining (using one options position to offset another) yet!

Leverage is core to traditional options trading, but this feature is non-existent in DeFi: selling a put on SPY requires $36,000 in a cash account and only $6,000 in a “margin” account. Both can net you $600 profit in ~40 days, but the capital efficiency of the margin account is 6x larger than cash, for the same risk profile

All these lead back to the crux of the issue: Until there is an efficient, secure way to price options, DeFi will never be able to support the multitude of use cases options are used for in TradFi. Many options protocols create obscure equations and compensating mechanisms to cope with these problems. Take a look at this excerpt from Dopex’s founder on twitter.

“Unlike protocols making use of flat IVs and black-scholes pricing which usually results in incorrect pricing across strikes and expiries especially farther out of the money, dopex uses a combination of RV (realized volatility), a volatility smile replicating formula and “delegates” who quote on multipliers that influence the steepness/dampness of curves formed by the pricing formula. This allows for the dopex option chain to be far more realistic and fair in terms of pricing.”

You get the idea… is there another way? Uniswap has taught us that there is no clear mapping of traditional financial instruments to DeFi on the Ethereum Virtual Machine (EVM). Before Uniswap and Bancor, on-chain order books were the direction builders were iterating upon. 0x had deployed a method for on-chain order settlement of trades in mid 2017 – the now elegant AMM equation must have seemed ludicrous back then.

Panoptics is an EVM-native response to these problems, and can do to options what Uniswap did to spot.

Panoptic: A new financial primitive

Panoptic is not in fact an options protocol.

By adjusting Uniswap V3 liquidity pool (LP) positions, Panoptic re-creates options like payoffs in a peer-to-pool model, without relying on Black-Scholes logic.

It’s core strengths are:

Leverage. The amount of collateral needed to sell an option can be less than 100% – Panoptic can support a minimum collateral ratio of 20% of the exercise value plus the option’s money-ness. Similarly, option buyers only need 10% of the notional size of options to open a position.

Maintaining composability and permissionlessness. Options positions are represented in the form of ERC1155 tokens and are composable with all of DeFi. Because Panoptic simply needs to adjust Uniswap V3 positions, all users can, theoretically, deploy an options market once a Uniswap V3 market exists, in a permissionless fashion.

Collaborative liquidity, not competitive liquidity. Panoptic can also be thought of as a virtual liquidity manager for Uniswap V3 positions, in the likes of Charm and Gamma. Options buyers and sellers, in the course of their trading, help to reposition liquidity at various prices. Liquidity providers can earn far more trading fees than if they opened a passive LP position, and an increase in Panoptic’s liquidity deepens liquidity on Uniswap as well. This may attract far more liquidity than the 250M TVL in options protocols today.

New financial features; positions never expire, and option premiums are not paid upfront – only when they are exercised. These premiums will increase as volatility of spot assets increases based on the Uniswap pool itself, not any oracles. If you understand that Uniswap V3 liquidity positions can act as buy limit and take-profit orders, you can understand how Panoptic works.

There are, of course, a multitude of risks to navigate. Gas fees incurred from virtual liquidity management might overrun the profitability of liquidity providers . As with all of DeFi, the line between protocol value extraction and value accrual remains.

DeFi is still in its infancy. 100 trillions of equities and bonds are traded daily and the DeFi market is barely at 1/10 of a trillion. I am excited to back Panoptic as they push the possibilities of exchanging risk in the free and sovereign world.

Read Panoptic’s whitepaper here.

Thanks to Duke from Alpha Lab Capital, Guillaume from Panoptic, and Gavin from Forward Analytic for their comments